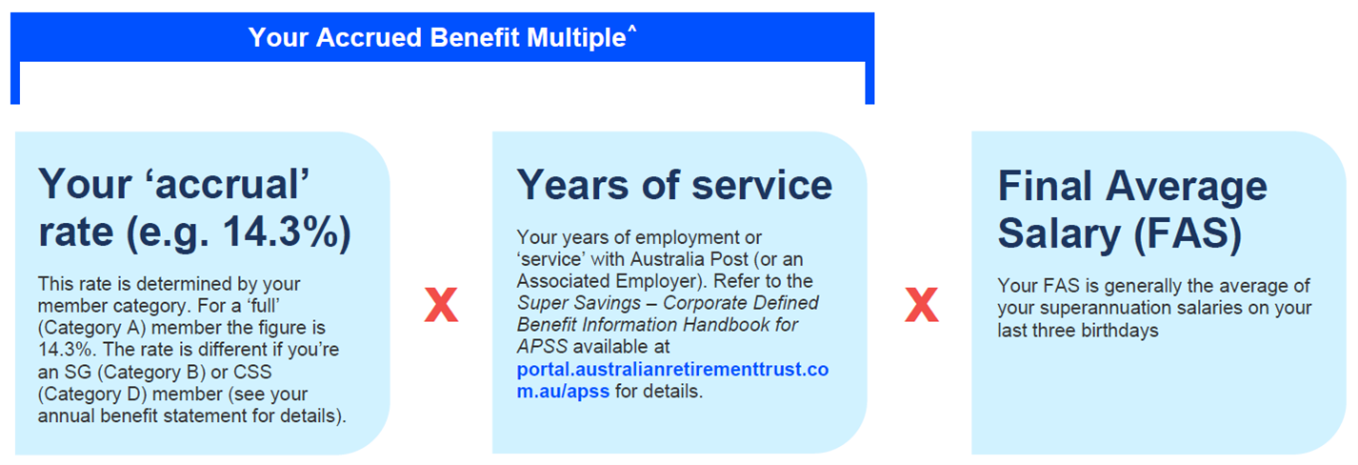

The Defined Benefit formula combines three elements, often expressed like this:

Your Accrued Benefit Multiple may comprise of one or more multiples. Refer to the Super Savings - Corporate Defined Benefit Information Handbook for APSS at portal.australianretirementtrust.com.au/apss for details.

Important information to consider

Calculating your Defined Benefit is only as simple as in the graphic above if you've only ever been a Category A (14.3%) member with, for example, no probationary service, no service as a Category B ('SG') Defined Benefit member, no pre-1 July 1990 service, and no 'catching-up' to do.

If one or more of these periods of service apply to you, the calculation of your Defined Benefit is more complicated as different accrual rates apply for each period. A multiple is generally derived by multiplying the relevant accrual rate used in your formula, for example 14.3%, by your years of service, adjusting for any part-time periods. For details on your specific benefit, please log in at member.secure.australianretirementtrust.com.au/login to check your details, and refer to the Super Savings - Corporate Defined Benefit Handbook for APSS available at portal.australianretirementtrust.com.au/apss.

Find out more

For more information about your Defined Benefit, please download the How does a Defined Benefit work? factsheet available at portal.australianretirementtrust.com.au/apss or contact us on 1800 652 643 between 8.00am and 6.30pm AEST, Monday to Friday.